ESR Impact on Business in UAE

Economic Substance Regulations (ESR) were introduced in the United Arab Emirates with effect from 30th April 2019 by the Cabinet Decision Number 31 of 2019. The introduction of ESR has pulled the attention of market masters just as of those various organizations which are in the investment business. Thus, it has become crucial that the […]

ESR Return Filing Deadline Extended Till 31st December 2020

The Ministry of Finance in the United Arab Emirates has issued a notice regarding Economic Substances Regulations (ESR) Filing Requirements and Deadlines. The deadline for ESR filings is due as the MOF (Ministry of Finance) portal availability is extended to 31st December 2020. So, all notifications & reports will require to be submitted online through […]

Importance of VAT Consultancy Services in UAE

Do you ever attempt to check your accounts and assess the spending, buying, employee payments, profits & so on? If yes, you realize that it is so hard to oversee accounts. Right continuation of accounting records will be one of the underlying prerequisites for any business to bear the new legislation. Appropriate recording of all […]

Know the Role of Internal Auditors in UAE

Expert internal auditors in UAE can provide you with the right assistance and guide you in all financial matters of your business. They can evaluate the effectiveness of the risk management, governance, & control processes of a business & advance them. Auditors can provide services to deal with problems that are essentially needed for the […]

Penalties for Non-Compliance with Economic Substance Regulations

Economic Substance regulations were introduced in the UAE to deliver greater transparency in taxation matters & also to guarantee that there is a healthy & fair tax competition in the nation. The regulations will ensure that the business substances in the UAE report the right measure of benefits picked up by the said financial movement […]

Reasons To Hire TAX Consultants In UAE

Have you ever attempted to evaluate accounts like purchase, payments & spending on your own business? If you have, then you would know the fact that it is so hard to oversee things. With changing tax rates, it is often hard to keep yourself updated with all the rules & regulations. As a taxable entity, […]

Why Small Businesses Need To Go For Accounting Services?

Small businesses are considered the financial backbone for most economies. They are drivers of development as they help produce occupations for millions, add to the GDP gains, and powerfully affect the neighbourhood economy. These are only a portion of the numerous commitments to socio-economic advancement in both developing & developed countries. In any case, similar […]

How To Apply For UAE VAT Reconsideration?

UAE VAT reconsideration permits a taxable individual to appeal for the review given by the FTA authority. All the organizations in the UAE must know about the VAT laws, which is always beneficial to smoothly run their business. If organizations don’t follow the tax laws gave by the Federal Tax Authority (FTA), they will get […]

New Updates of Economic Substance Regulations in UAE

ESR (Economic Substance Regulations) were launched in the UAE with effect from 30th April 2019. The UAE Cabinet of Ministers of UAE has now issued Updated ESR on 10th August 2020 which repeals & replaces the ESR. The Ministry of Finance in UAE has also issued updated guidance expounding the Updated ESR. The New ESR […]

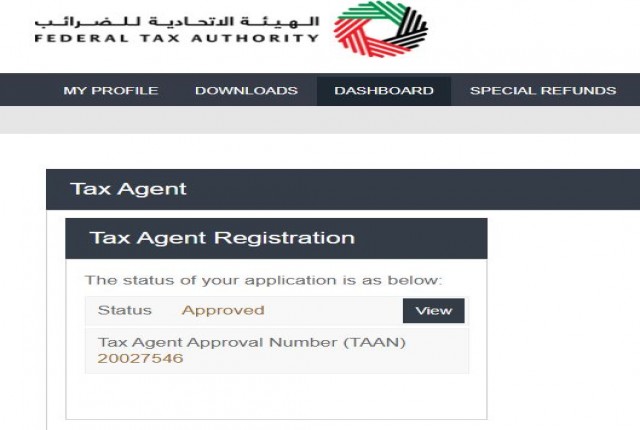

FTA Approved Tax Agency in UAE

The Federal Law No (7) of 2017 on tax procedures specifies the appointment of a tax agent to represent taxable persons before the Federal tax authority (FTA) with regards to his tax affairs and taxable obligations. Federal Law No. (7) of 2017 on Tax Procedures states tax agents as: “Any Person registered with the Authority within […]