EXCISE TAX IN THE UAE

Excise tax is the indirect tax levied on certain goods that are considered to be harmful to the health of human beings. The objective behind the introduction of the excise tax in the UAE is to reduce their consumption so that it promotes a healthy lifestyle in the nation. Excise tax in the UAE will […]

Auditing companies in Dubai

An auditing company is a firm that reviews activities to identify inefficiencies, cost reduction, or else achieve organizational goals. Auditing companies may spy on possible theft or fraud and ensure conformity with applicable regulations and policies. ARC Associates is a group of auditors and accountants, established in Dubai, providing comprehensive services in audit, finance, accounting, […]

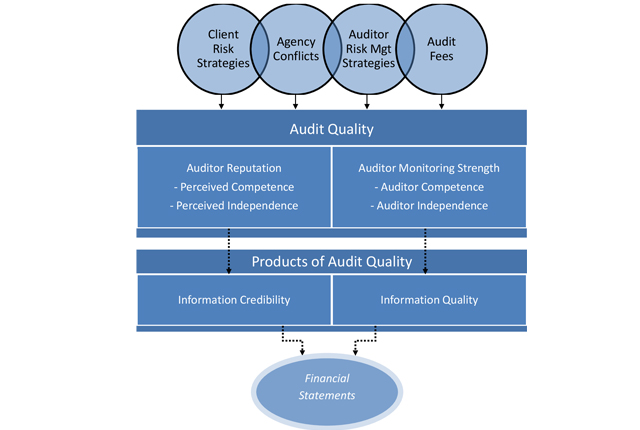

Relationship between Auditor-Client & Audit Quality

An auditor has to display extra miles of tact and wisdom when dealing with a client. The attitude, approach, and psychology of each client differ as it can be likened to the five fingers of our palm. At the outset, the auditor has to give a feeling and confidence to the client that his advice […]

Risk Audit

We always hear the word “Risk†in the audit atmosphere these days. Risk has become so important in audit parlance that we have specialized in “risk audit†training now. There are also auditors who have obtained special training on risk audit. Risk audit is defined as the uncertainty of an event occurring that could […]

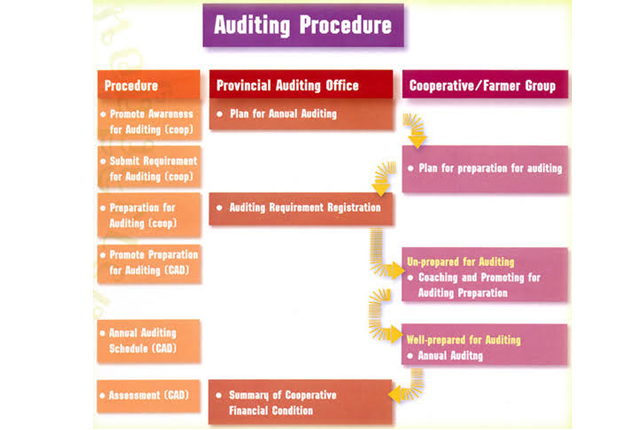

Procedure of Auditing

Auditing refers to a systematic and independent examination of accounts, books, documents, and vouchers of an organization to clarify whether financial statements present true or fall. Auditing Procedures attempts to verify that the books of accounts are properly maintained as per the Law. It is the process of reviewing and investigating any aspect of the […]

VAT Consultants in Dubai

VAT Consultants in Dubai: ARC Associates – Accountants and Auditors in Dubai provide the best vat consultancy services to the clients in Dubai. We at ARC Associates have a great team that caters to the clients as their consultants. With the introduction of taxation in the UAE and the implementation of VAT in Dubai, we […]

VAT Return Filing Deadline Approaching Soon

All the VAT registrants, whose tax period is ending on 31st May 2018, will have to submit their returns by 28th June, the deadline set by the Federal Tax Authority. According to the reports, the FTA has already started receiving tax returns through the e-Services portal of the official website. It urged all registered businesses […]

How You Can Use Tax Agencies?

The Federal Tax Authority (FTA) has decided to introduce new features to the e-Services portal that will let the Taxable Persons link their accounts with accredited Tax Agencies, where the Agency will carry out all the transactions within the account on behalf of the Taxable Person. Transactions may include registration procedures, tax return submission, etc. […]

Check Whether You Are eligible For VAT Recovery

While purchasing goods and services you are supposed to pay input VAT on that purchase, and if you are a VAT registered person you might be able to reclaim the amount paid on specific items. > To make taxable supplies > Supplies that are made outside UAE, but treated as taxable in UAE […]

Are You an Importer to Dubai? Then You should know this

Are you a VAT registered importer to Dubai? As a VAT registered importer to Dubai, importing and exporting taxable goods in UAE are liable to pay tax. The payment of tax is accounted for through the reverse charge mechanism. Under certain circumstances, importing taxable goods into a VAT designated zone or transferring taxable goods […]